Road-related Revenue and Expenditure

Chapter 3

This chapter provides information on the Government's total expenditures and sources of revenue for road-related activities for the Commonwealth, state and local Government (noting only expenditure is shown at the local level). A general overview for the Commonwealth is presented first, before expenditures (Table 3.1) and revenues (Table 3.2) are broken down at state/territory level. A variety of sources are used for this data, including data from the Australian Tax Office, the Australian Bureau of Statistics, the Department of Infrastructure, Transport, Regional Development, Communications and the Arts, the Commonwealth Budget, BITRE estimates and State and Territory Governments. For a more detailed breakdown, please refer to the endnotes for Chaptere 3.

- The public sector (National, state and local) spent $39 billion in roads in 2022–23.

- $31 billion in road-related revenue was collected (excluding road-related revenue from the Goods and Services Tax, Fringe Benefits Tax and the Luxury Car Tax).

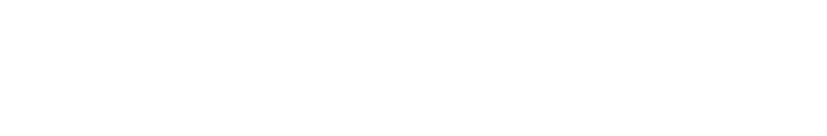

Public sector road-related expenditure over time can be seen in Figuree 6.

Figure 6 Road-related expenditure, by level of government (constant 2022–23 prices, adjusted by CPI)

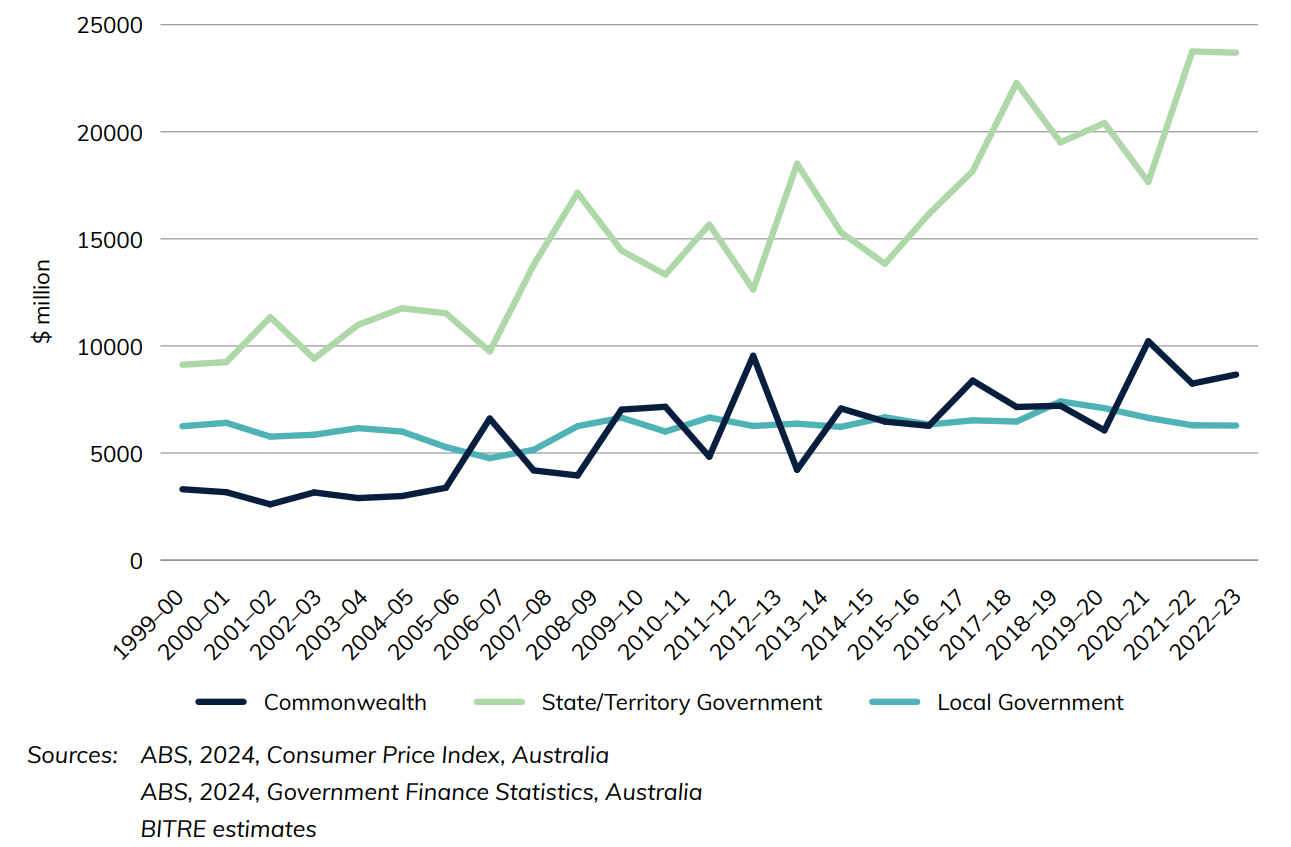

Figure 7 shows selected road-related revenues

Figure 7 Selected road-related revenues

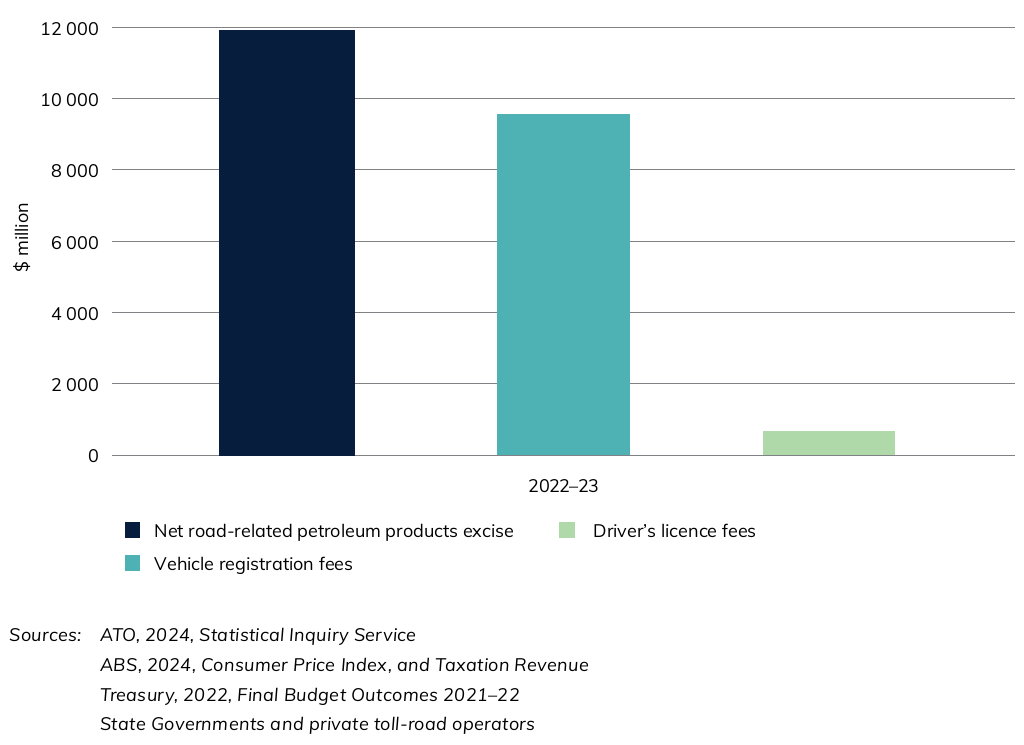

Figure 8 illustrates that the majority of revenue for the states/territories is vehicle registration fees.

Figure 8 State and Territory Government Road-related revenues (excluding tolls)

Download data

- Road-related Revenue and Expenditure—Yearbook 2024 (234 KB) - Download Excel file

- Australian Infrastructure and Transport Statistics—Yearbook 2024 - Download PDF